What is an issuing bank and an acquiring bank?

Publication date: 2026-01-29

Paying for purchases with a bank card has long been commonplace. We tap our card on a terminal or enter its details online without thinking about the processes taking place behind the scenes. In fact, with every transaction, the issuing and acquiring banks exchange information in a matter of seconds to ensure the payment is successful. Below, we'll explore the meaning of each of these terms, the functions performed by the issuing and acquiring banks, and how they interact.

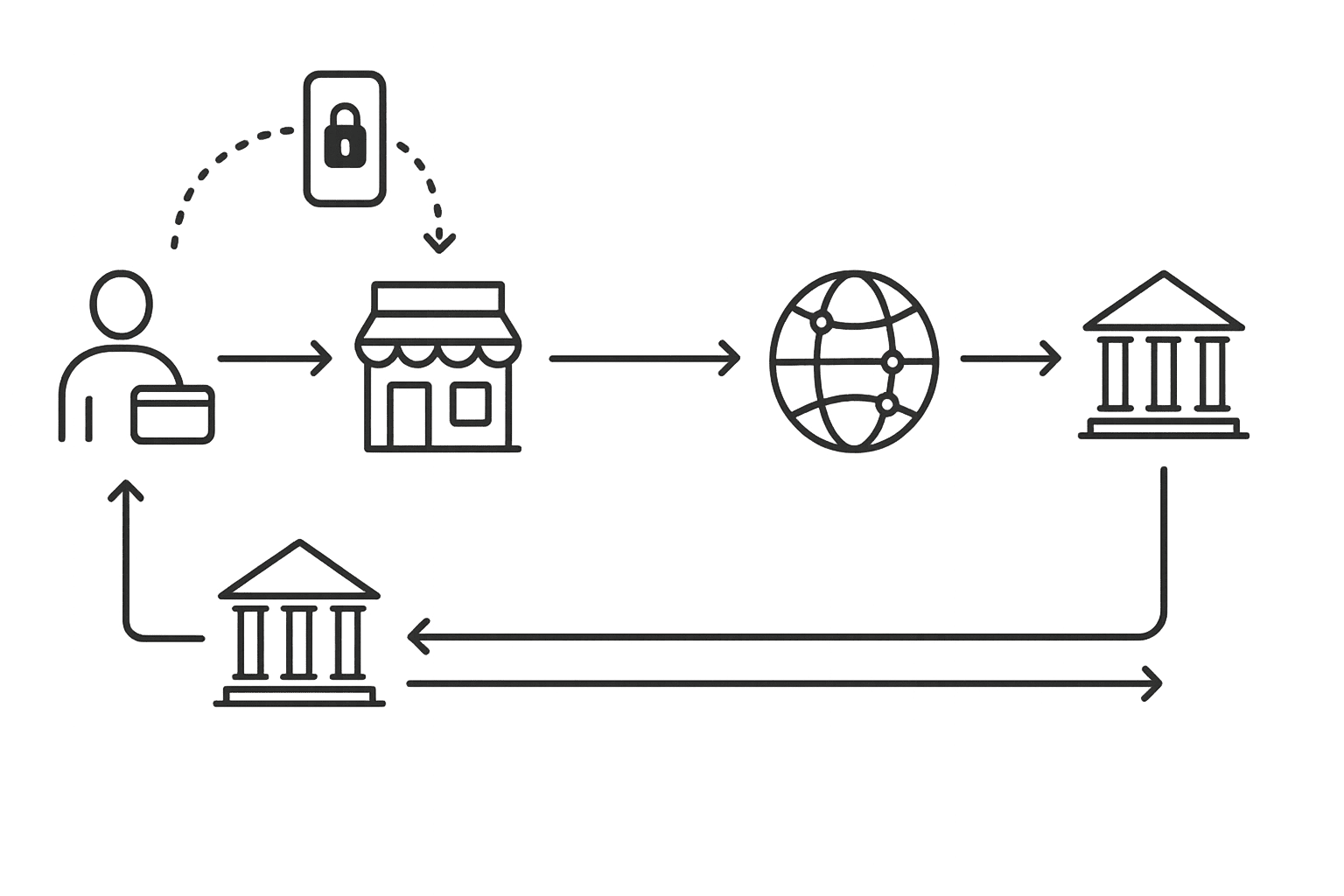

The interaction scheme between the issuing bank and the acquiring bank when processing a card payment (issuer is the issuing bank, acquirer is the acquiring bank, the payment system acts as an intermediary).

What is an issuing bank?

An issuing bank is the bank that issues and services clients' bank cards. In other words, it's the bank that opened your card account and issued your plastic (or digital) card. The issuing bank's name is usually indicated on the card itself (via a logo or inscription). The issuing bank is a member of a payment system (e.g., Visa, Mastercard, etc.) and is responsible for the financial obligations arising from the card's use.The issuing bank serves the cardholder – its customer – and can therefore be called the "buyer's bank" in the transaction. When you pay with your card in a store, the issuing bank verifies that funds can be debited from your account and authorizes the payment. In Kazakhstan, almost all major financial institutions are issuing banks, issuing debit and credit cards to the public (Halyk Bank, Kaspi Bank, ForteBank, Alatau City Bank, Bank RBK, etc.).

What are the rights and responsibilities of the issuing bank?

Issuing bank rights. This bank independently sets the terms and conditions for issuing and servicing its cards, including rates, transaction fees, credit limits, and other service parameters. The issuer reserves the right to determine card usage rules (e.g., cash withdrawal limits, international use), and, if necessary, block the card or suspend transactions (e.g., if fraud is suspected or the terms of the agreement are violated). The issuing bank reserves the right to charge service fees (e.g., annual card maintenance), issue new types of cards, and change the design and functionality of the product at its own discretion – of course, within the framework of the law and the agreement with the client.Issuing Bank Responsibilities. The issuer is responsible for the smooth operation of the cards it issues and the accounts associated with them. Their primary responsibility is to ensure that cardholders fulfill their financial obligations. For example, the bank ensures that clients do not exceed their credit limit and repay their credit card balances on time, as well as that unauthorized overdrafts do not occur on debit cards. The issuing bank is obligated to protect cardholders' funds and personal data, promptly block lost or compromised cards, and handle customer complaints regarding incorrect charges and disputed transactions. Furthermore, the issuer must comply with legal requirements and regulatory standards: identify clients, monitor suspicious transactions (AML/KYC), and adhere to payment system rules (e.g., transaction security, permitted transactions, and reporting). Thus, the issuer's rights grant it broad scope for managing card products, while its responsibilities ensure the protection of clients' interests and the stability of the financial system.

What requirements apply to the issuing bank?

Issuing banks are subject to strict requirements from both government regulators and international payment systems. First, the organization must be licensed to conduct banking operations (i.e., be an officially registered bank). Second, the bank must meet the requirements of the payment systems for participation, including financial stability, the necessary technological equipment, and compliance with security standards. For example, to issue Visa or Mastercard cards, the issuing bank must become a principal or associate member of these payment systems and comply with their terms. It must also have a processing center (either its own or an external processing provider) to process card transactions. The issuing bank must also comply with information security standards (PCI DSS) when storing and processing card data and implement security technologies (EMV chips, 3-D Secure for online payments, etc.).From a legal perspective, the issuer is responsible for issuing payment instruments and must comply with all regulations established by the regulator. In Kazakhstan, requirements for issuing banks are established by the National Bank of the Republic of Kazakhstan and payment services regulations. The issuing bank must have sufficient capital, comply with prudential standards, and ensure uninterrupted service and reporting. To summarize, the issuing bank must comply with all legal and financial regulatory requirements related to the issuance and servicing of payment cards. Only if these conditions are met does the bank obtain the right to issue bank cards and fully operate within the payment system.

How to find out the issuing bank?

There are several ways to find out which bank issues your card:• On the plastic itself. The name of the issuing bank is indicated on the front or back of the bank card (usually the bank's logo or brand). For example, if the card says "Kaspi Bank ," then the issuer of that card is Kaspi Bank.

• By card number. Each issuing bank has its own Bank Identification Number (BIN) –a unique code encoded in the first digits of the card number. The first 4–6 digits of the number can be used to identify the bank that issued the card. Online services and BIN directories exist for this purpose. For example, if a card begins with a certain combination of numbers, the payment system recognizes the issuing bank by this code.

• Via an ATM/terminal. When you perform a card transaction (cash withdrawal, payment), the system automatically detects the issuing bank. The ATM or POS terminal displays information about the issuing bank and can indicate the transaction fee for a non-issuing card. Therefore, simply inserting your card into an ATM usually immediately identifies the bank that issued it.

What types of issuing banks are there?

The issuing bank is typically a commercial bank licensed by a regulator and connected to international payment systems. Almost any bank can be an issuer if it issues bank cards to clients. Issuing banks can be broadly categorized by specialization and the types of cards they issue. For example, some large universal banks issue a full range of cards–debit, credit, premium, co-branded, etc. Other financial institutions may specialize in a particular segment: some banks focus on the mass issuance of debit cards (for example, salary cards), others focus on credit cards and installment plans, and still others issue prepaid (virtual) cards for online payments. There are also banks that issue cards jointly with partners (co-branding), for example, in collaboration with retail chains or airlines. However, regardless of specialization, an issuing bank is any bank that issues bank cards and performs their servicing functions. In Kazakhstan, dozens of banks currently issue payment cards, including large universal banks and small niche organizations.Functions of the issuing bank

The issuing bank plays a key role in the payment system, providing customers with bank cards and monitoring transactions. It issues and processes cards, opening the card account linked to the card. Although the card remains the property of the bank, the customer receives it for use under the terms of the agreement. The issuer is responsible for transaction authorization: upon receiving a request from the acquiring bank, it verifies the customer's details and account status, and then either approves or rejects the transaction, essentially guaranteeing the merchant payment for the purchase if the customer has sufficient funds.Once the transaction is approved, the issuing bank debits the cardholder's account and subsequently transfers these funds to the acquiring bank for credit to the merchant, acting as an intermediary between the buyer and the merchant. The issuer also maintains records of all account transactions, providing the customer with statements, informing them of outstanding balances, and monitoring their repayment. It also provides customer service, including handling disputes such as chargebacks.

Security is another important function of the issuer. The bank monitors the security of transactions, blocks cards or individual transactions if fraud is suspected, issues reissued cards, and implements security technologies, including PIN codes and 3D Secure for online payments. The issuer exchanges information with other banks so that customers can withdraw cash from third-party ATMs.

By issuing a card, the issuing bank guarantees that the cardholder will be able to pay within the balance or credit limit. Often, the same organization can simultaneously serve as both issuer and acquirer. For example, when withdrawing cash from an ATM of a "home" bank, it performs both roles, whereas when paying with a card from Bank A at a terminal of Bank B, Bank A is the issuer and Bank B is the acquirer.

What is a card issuer?

A card issuer is the same as the issuing bank, that is, the bank that issued the bank card. Sometimes the term "issuer" is used more broadly, referring to an organization that issues securities or financial instruments. However, in the context of bank cards, the issuer is always the bank that opened your account and provided the card for use. Simply put, if you have a card from any bank, the card issuer is the bank that issued and services it (its name is indicated on the card). For example, the issuer of the Halyk Bank Visa card is Halyk Bank, since it issued the card and services it.What is an acquiring bank?

An acquiring bank is a bank that accepts and processes bank card payments. It is often referred to as a "merchant's bank" because it services businesses that accept cards. An acquiring bank provides acquiring services to businesses, installing payment terminals at retail locations, integrating online acquiring for online stores, and processing ATM transactions. The acquirer receives the payment request when you swipe your card and interacts with the issuing bank through the payment system to obtain authorization.Simply put, an acquiring bank is the bank that services the payment acceptance point. It owns the infrastructure for card acceptance: terminals, POS terminals, ATMs, and transaction processing software. The acquiring bank's logo or name can be seen on the POS terminal in a store or on the ATM itself. The acquirer is responsible for ensuring that the buyer can pay with the card and the merchant receives the money. In Kazakhstan, many banks (for example, Halyk Bank, Kaspi Bank, Bank CenterCredit, etc.) provide acquiring services to businesses, as do payment services that partner with banks.

Functions of the acquiring bank

As an intermediary between the merchant and the payment system, the acquiring bank performs the following key functions:• Payment acceptance organization. The acquirer provides the merchant with the necessary equipment and software to accept cashless payments (POS terminals for cards, QR codes, online gateways, etc.). The bank installs and configures the terminals, trains staff to use them, and provides maintenance.

• Technical and customer support. The acquirer assists the merchant (enterprise) with all acquiring-related matters. They provide 24/7 support, from consultations on equipment operation to urgent repairs or replacement of the terminal in the event of a malfunction. The bank also monitors the correct operation of the system and helps prevent payment acceptance failures.

• Transaction authorization. When a customer swipes a card, the acquirer receives encrypted data from the terminal and sends a request to the payment system for authorization. The request is sent through the processing center to the issuing bank, and the acquirer receives a response – approval or denial of the transaction. If approved, the terminal prints a receipt, confirming the successful payment.

• Funds Transfer to the Merchant. The acquiring bank handles settlements for accepted payments. It debits the buyer's account (through interaction with the issuer) and credits it to the merchant's bank account. Typically, at the end of the business day, the acquirer generates a consolidated register of all transactions and transfers it to its processing center or payment system for final clearing. The issuer then transfers the funds to the acquirer, which then credits them to the merchant.

• Document management. The acquirer is responsible for generating cash receipts and electronic transaction logs. Each payment made through a POS terminal is accompanied by the printing of two receipts – one for the buyer and one for the merchant. The bank also ensures the accounting of all transactions and provides the merchant with reports on completed non-cash payments. This simplifies business accounting and allows for revenue tracking.

• Ensuring security and compliance. Large acquiring banks implement transaction security measures, including monitoring suspicious transactions, using blacklists of stolen or blocked cards, and adhering to the PCI DSS standard when handling card data. Acquirers are also obligated to comply with legal requirements (for example, the Law of the Republic of Kazakhstan "On the Protection of Consumer Rights" (dated May 4, 2010, No. 274-IV), which requires card acceptance at a certain turnover). A reliable acquiring bank guarantees both convenience and payment security for both the customer and the merchant.

Results

The issuing bank and the acquiring bank are the two key participants in the cashless card payment process. The issuer acts on the buyer's side, issuing the card and managing the customer's account, while the acquirer acts on the merchant's side, arranging payment acceptance and servicing the merchant. For each transaction, these banks interact through the payment system: the acquirer requests authorization from the issuer to debit funds, the issuer verifies the customer's account and responds, after which the acquirer credits the funds to the merchant's account. This entire complex chain occurs automatically in a matter of seconds and is invisible to the user.It's worth noting that the same bank can act as both the issuer and acquirer. For example, if a Kaspi Bank cardholder pays with the same card via Kaspi Pay in a store, Kaspi acts as both the issuing bank and the acquiring bank. However, in general, payments involve different banks, and their cooperation enables convenient payments worldwide. Thanks to the coordinated work of issuers and acquirers, cardholders can make purchases anywhere, and businesses can seamlessly accept payments.

PAYGATE is your reliable partner for modern payment solutions. We help Kazakhstani businesses integrate acquiring and other financial services, ensuring convenient and secure payment acceptance. If you'd like to learn more and find the optimal solution for your project, contact PayGate, and we'll be happy to help you set up payment acceptance on favorable terms.

Author: Paygate

Subscribe to our Blogs

Receive the most useful information about the global electronic and mobile commerce market in your email