Card acquiring

Advantages

Market coverage

Accept payments from all over the world in any currency with popular bank cards

High conversion

Conversion of successfully accepted payments up to 98%

Multi-functional payment widget

Customize online payments for the specific needs of your business and customer

Security

PayGate has passed international data protection certification PCI DSS and complies with all banking standards

Market coverage

Accept payments from all over the world in any currency with popular bank cards

High conversion

Conversion of successfully accepted payments up to 98%

Multi-functional payment widget

Customize online payments for the specific needs of your business and customer

Security

PayGate has passed international data protection certification PCI DSS and complies with all banking standards

PayGate's card acquiring will surprise you with its simplicity of connection and level of service. You will be able to accept payments from all over the world in any currency with the most popular payment systems, such as Visa, MasterCard, UnionPay, and others. This is a universal and essential solution for trading and service provision.

With PayGate, you get all the necessary functionality for card payments on your website, application, and social networks in one place: a seller's personal account, easy integration with CMS, multi-acquiring, simplified returns, recurring payments, invoice payments, QR payments, payments via links, and electronic wallets such as Google Pay and Apple Pay.For technology platforms, API documentation, round-the-clock technical support, and direct contacts with our specialists are available. You can always contact us conveniently and get the necessary answers, regardless of time and language.

Provide your customers with the most simple and seamless payment process and thereby increase your revenue.

Advantages of a local acquirer for merchants

Local acquirers are familiar with regional regulations, ensuring transactions adhere to local laws and minimizing legal risks.

• Higher Approval Rates.

Local acquirers understand their customers' spending behaviors, leading to more successful transactions and fewer declines.

• Reduced Costs.

Transactions through local acquirers often incur lower fees by avoiding cross-border charges and currency conversion fees, contributing to long-term savings and improved profitability.

• Enhanced Customer Experience.

Local payment gateways typically offer faster transaction processing times, instilling trust in customers and potentially boosting sales.

• Decreased Risk of Denials.

International transactions are more likely to face denials due to fraud concerns, making local processing a safer option.

Examples of flow in real life

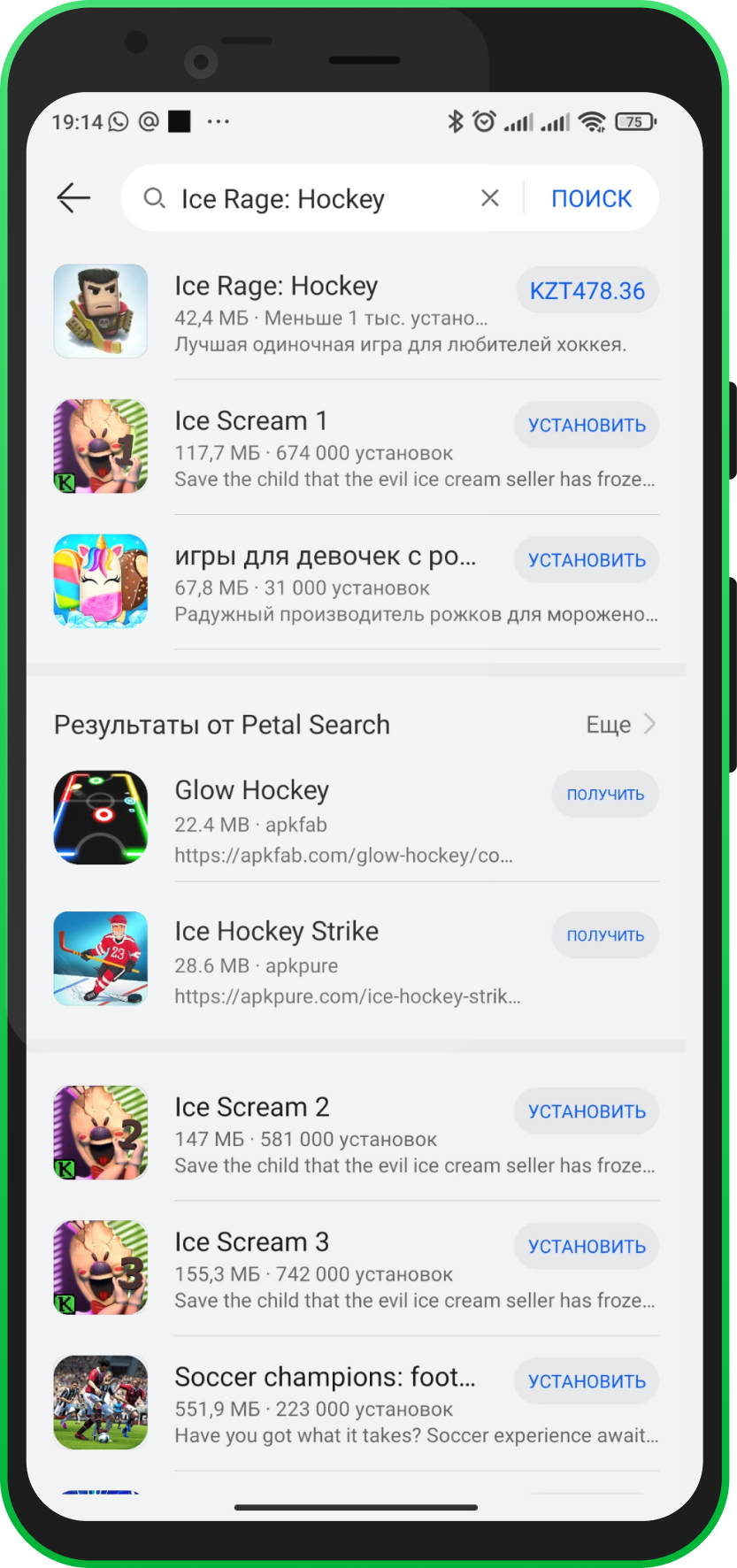

Mobile Payments for Application store

Task Development and implementation of mobile online payments in the Kazakhstan market for one of the world's largest telecommunications corporations using Direct Carrier Billing (DCB) technology Result Residents of Kazakhstan now have the ability to pay for all their purchases in the Application store not only with a bank card but also from their mobile account of the largest mobile operators in the country. One of the main advantages of this payment method (DCB) is its anonymity - there is no need to share your bank details with the application. The client increased the coverage of their service to 70% of Kazakhstan subscribers, with the technical possibility of expanding to 100%

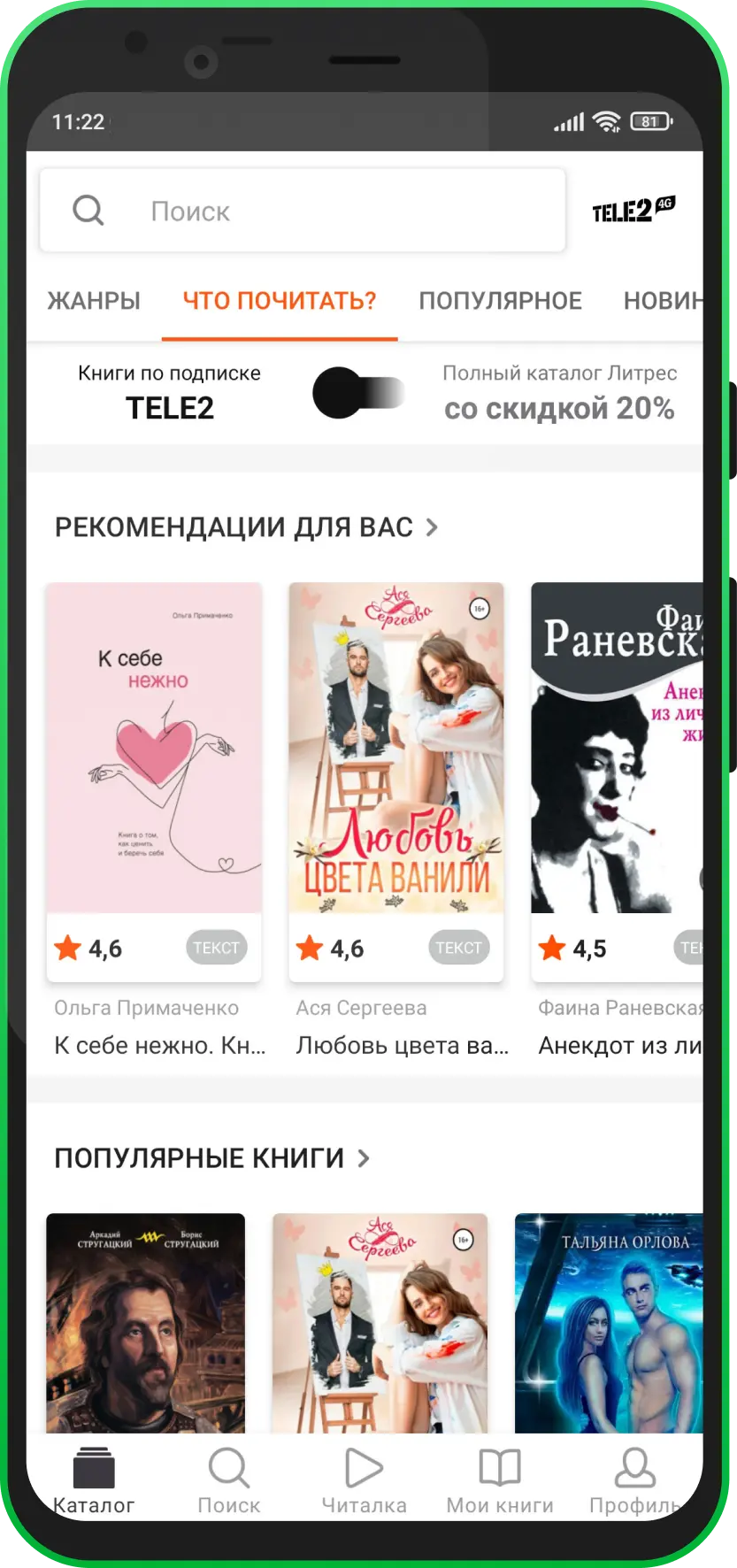

Mobile commerce for the e-book service LitRes

Task Integration of a co-branding project for the e-book service LitRes and the mobile operator Tele2 - implementation of subscription payment and billing configuration using the subscriber's mobile account (DCB) Result Tele2 subscribers gained access to the LitRes library, which includes more than 250,000 books and 50,000 audiobooks, with the option to register via SMS and pay for a subscription using their mobile account. Through technical support from PayGate, the companies LitRes and Tele2 mutually expanded their customer base and improved their service level by implementing DCB technology

Mobile commerce for National Lottery

Task Development and implementation of a project to introduce a mobile payment tool DCB (Direct carrier billing) for the National Lottery of Kazakhstan Result Subscribers of all mobile operators in Kazakhstan were able to buy lottery tickets and receive winnings using their mobile account. With the expertise of PayGate, the National Lottery added DCB technology to its payment methods, which ultimately led to the popularity of this payment method on par with bank cards

We have already gained trust from more than 110 companies worldwide

Let's discuss how we can make your payments more efficient